Optional Products

- Home

- Optional Products

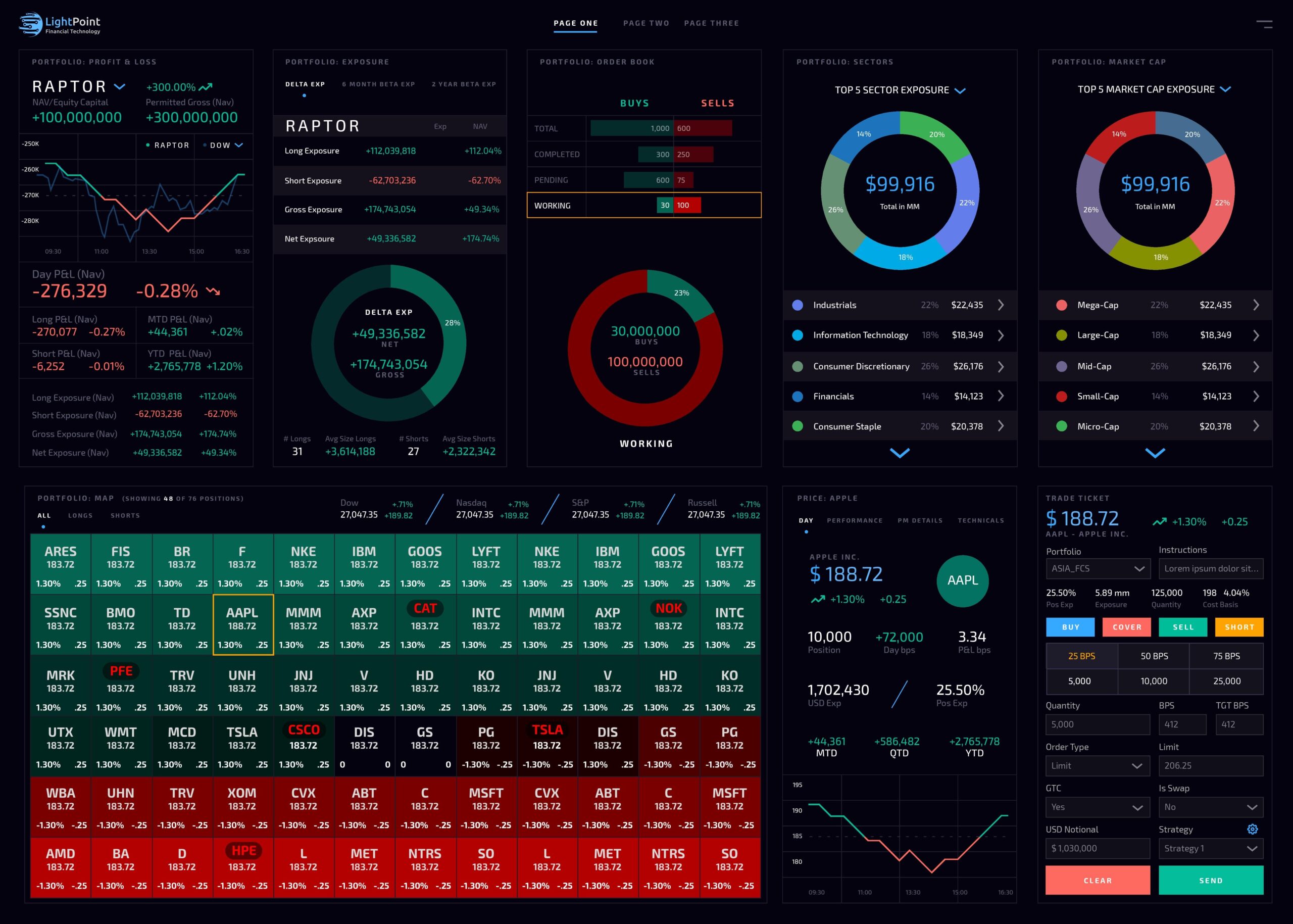

Advanced Order Execution Management

Advanced Order Execution Management

This functionality is supplied by our partner InfoReach, one of the leading providers of OEMS software to the buy and sell side. We have integrated their EMS product with our Security Master, Market Data, Compliance, Trade Ticket and Portfolio Management services to offer our buy and sell side customers an integrated desktop that can help them spot, seize and manage new market opportunities, automate trading strategies, minimize risk, improve execution quality, reduce transaction costs and keep up with changes in market structure and regulation. The InforReach systems features include:

- Integration with our Trade Ticket services allow orders to automatically be routed to the trading desk for execution and for pre and post-trade analysis.

- Integration with our Market Data Server and our Security Master allows the customer to choose the market and reference data they need, including level 2 data if required.

- Integration with our Compliance Management module ensures that there is a single source of truth for pre and post trade compliance rules.

- Provides low-latency, high-volume trade execution.

- Supports manual, algorithmic and automated trading.

- Provides a black box development and testing environment for algorithmic trading.

- Supports real-time, interactive charting and position monitoring.

- Provides access to global brokerage services and strategies for multi- and cross-asset trading.

- Provides direct market access (DMA) for trading.

- Supports high-frequency trading and an algorithmic development engine.

Investor Management & Accounting

Investor Management & Accounting

This functionality is supplied by our partner Deep Pool and their ManTra product, which is one of the leading products in the investor management and accounting space. Utilized by Asset Managers, Hedge Funds and Fund Administrators, Mantra has been tightly integrated with LightPoints Portfolio Accounting system to provide a complete seamless valuation process, from GL balance creation to investor allocation and final valuation. ManTra API’s are used to pass LightPoint GL position valuations into the ManTra system where that data is combined with investor data to produce a set of final valuations that are used by the LightPoint’s portfolio accounting system to produce the final NAV for each fund. The ManTra systems features include:

API’s for the complete valuation process from GL Balance to Allocations to valuation creation.

- Allocation Processing Engine: Allocates the LightPoint General Ledger income to the fund and investor structures.

- Compliance Engine: Provides KYC and AML compliance using multi-level conditional rules and suspicious person/OFAC lists. Also provides FATCA and FormPF reporting.

- Core Investor Services Platform: Manages investor data and reporting. It can be driven from an API and can handle multiple fund structures and multiple valuations per day.

Provides KYC and AML compliance using multi-level conditional rules and suspicious person/OFAC lists. Also provides FATCA and FormPF reporting.

- Core Investor Services Platform: Manages investor data and reporting. It can be driven from an API and can handle multiple fund structures and multiple valuations per day.

Provides a comprehensive settlement and banking portal for investor servicing that is intuitive and easy to use.

Provides a dashboard for workflow management that supports KPI’s with drill down capabilities. It can be used to track trade, compliance, static data and user defined workflows.

Allows users to create custom document workflows for managing and organizing investor documentation. Documents can be imported or uploaded via ManTra Web. Links can be created by users to specific rules, requirements, bank details, settlements, allocations, valuations and tasks.

Allows a user to create custom maker/checker workflow on individual ManTra windows. Pending workflow items can be displayed on the ManTra Dashboard and a full audit trail is maintained on all maker/checker workflows.

A configurable engine for processing all types of fees including performance, management, transaction, and trail fees. The engine supports complex calculations, tiered fee rates and complex caps and floors.

- ManTra Rules Engine: Allows a user to configure rules that are associated with Trade Order and Entity processing. Supports flexible messaging for breached or missing requirements that include both pop-up messages and hard stops. Handles validation rule exception and parent/child rule options. The system tracks rules execution and provides status erporting.

- ManTra Web: Provides a secure, multi-lingual Web based portal that can be used by ManTra customers to communicate with the clients and investors. The portal is highly customizable and includes out of the box functionality for displaying account transaction detail, client documents, and custom reports.

- Payments Processing: Provides a multi-layer payments and authentication process that fully integrates with the ManTra settlements process. Provides payment status notifications including acknowledgement and bank cut off times. Integrates with messaging protocols including ISO 20022.

- Reporting Engine: Provides users with a flexible tool for generating custom reports. The system can also be white labeled for customers. It provides a comprehensive library of pre-existing internal and external reports that a customer can tailor to fit their needs. Reports can be distributed via, email, Fax and SFTP file transfer with complete audit trails.

- User and Data Security: Provides an extensive set of application security that leverages all of Microsoft’s Windows and SQL Server security policies around user logins. All client server communications are encrypted and application use is restricted using a role based permissions model.

Business Analytics Platform

Business Analytics Platform

This platform provides our customers with an open near-time data warehouse for housing all of their trade and financial data. Built using Microsoft’s SQL Server and their Business Intelligence platform. This cloud native environment requires no specialized technical support and allows users to create their own personalized dashboards and custom reports that can be displayed on computers or mobile devices. This approach will save firms money by eliminating the technical support that is required by many data warehouse solutions. Some of its features include:

- The platform can get its data from the customer’s fund administrator, legacy OMS, or the LightPoint OMS, depending on their requirements.

- Data can be loaded into either LightPoint Core’s transactional schema or directly into the data warehouse, depending on the client needs.

- The data warehouse is a bi- temporal schema that is implemented using Microsoft SQL Server.

- The warehouse feeds data into the Microsoft Business Intelligence environment, which is used to create a set of default dashboards and reports that can provide time series reporting.

- A user can tailor these dashboards and reports to reflect their unique needs or can easily create their own custom reports and dashboards.

- All reports and dashboards are available in a browser or on mobile devices.

- Reporting is interactive.

- Paginated Reporting on selected historic data surfaced on the LightPoint Data Warehouse and Analysis Services Semantic Layer.

- Excel Integration is very simple and is fully supported by Microsoft.

- No specialized technical support required since Power BI provides agile inquiry and analysis without the need for specialized technical support. It has a powerful natural language interface and the use of intuitive graphical designer tools.

- In-Memory access technology ensures that all of the queries will be lightning fast.

Market Data Platform

Market Data Platform

The Market Data Platform provides a single API for multiple sources of market data. Some features of the platform include:

- Support for three different market data providers, SIX Financial, FactSet and Bloomberg.

- The platform was designed to allow for the addition of new market data sources, giving companies a single place to manage and access their market data

- The cloud-native architecture provides a cost-effective single touch point for all the market data needs of a buy-side or sell-side firm.

- The systems architecture enables multi-tenant clients, such as Prime Brokers, to support multiple legal entities without the need to become a re-distributor of the market data.

- Extensive authentication and authorization model can meet the reporting demands of the most rigorous exchanges.

- The ability to provide access to all types of market data vendors through a single interface allows LightPoints support team to effectively transition client legacy applications onto SIX.

Valuation Engine

Valuation Engine

The valuation engine provide an independent fully transparent way for our clients to price OTC derivative instruments. The service is built around the QuantLib open source pricing library, which is one of the most widely utilized libraries in the world. It provides full transparency in that our customers can upload the library source code for model validation if required. Valuation engine features include:

- The same analytic can be used as a LightPoint service or in Excel.

- The data to support the OTC pricing can be sourced from Bloomberg, FactSet, SIX Financial or a customer specified source.

- The library is integrated with Python and can be accessed through Jupyter notebooks.